Since the outbreak of the Covid pandemic, production facilities in Asia have been inactive for months, and that's where the majority of semiconductors are manufactured. In terms of value creation, the German car industry has become dependent on Asian suppliers – which the P3 Group calls a “repeat mistake” that had been made with batteries before. Factory shutdowns have also impacted supply networks, leading to longer delivery times. The semiconductor supply chain is long and global, involving many specialized fields, so shortages created by operating restrictions in one region can lead to bottlenecks in others.

This time, however, the big catalyst was the Covid pandemic: stressing a recession, many automakers canceled orders in 2020. This did not result in the consumer dip in the car market, and at the same time, demand for semiconductors in the entertainment industry grew significantly. The subsequent alternation of lockdowns and opening booms combined with other unfavorable factors remember, the container ship transverse in the Suez Canal led to a regular stall. A problem that continues to this day.

For example, the lockdown in Shanghai is only gradually reduced, so the traffic jam in the world’s largest port is far from resolved. If you look at the seaports with the highest container throughput, almost all of them are in Asia: Shanghai is followed by Singapore, Ningbo-Zhoushan, Shenzhen, and Guangzhou-Nansha. Presently, ships are sailing at high speed without regard to heavy oil consumption to compensate for the shortfall. The prices paid for semiconductors have multiplied, making this spurt financially viable. The next bottleneck looms after arrival in Europe, i.e. in Rotterdam, Antwerp, and Hamburg, because the ports must diligently manage the massive volume of goods.

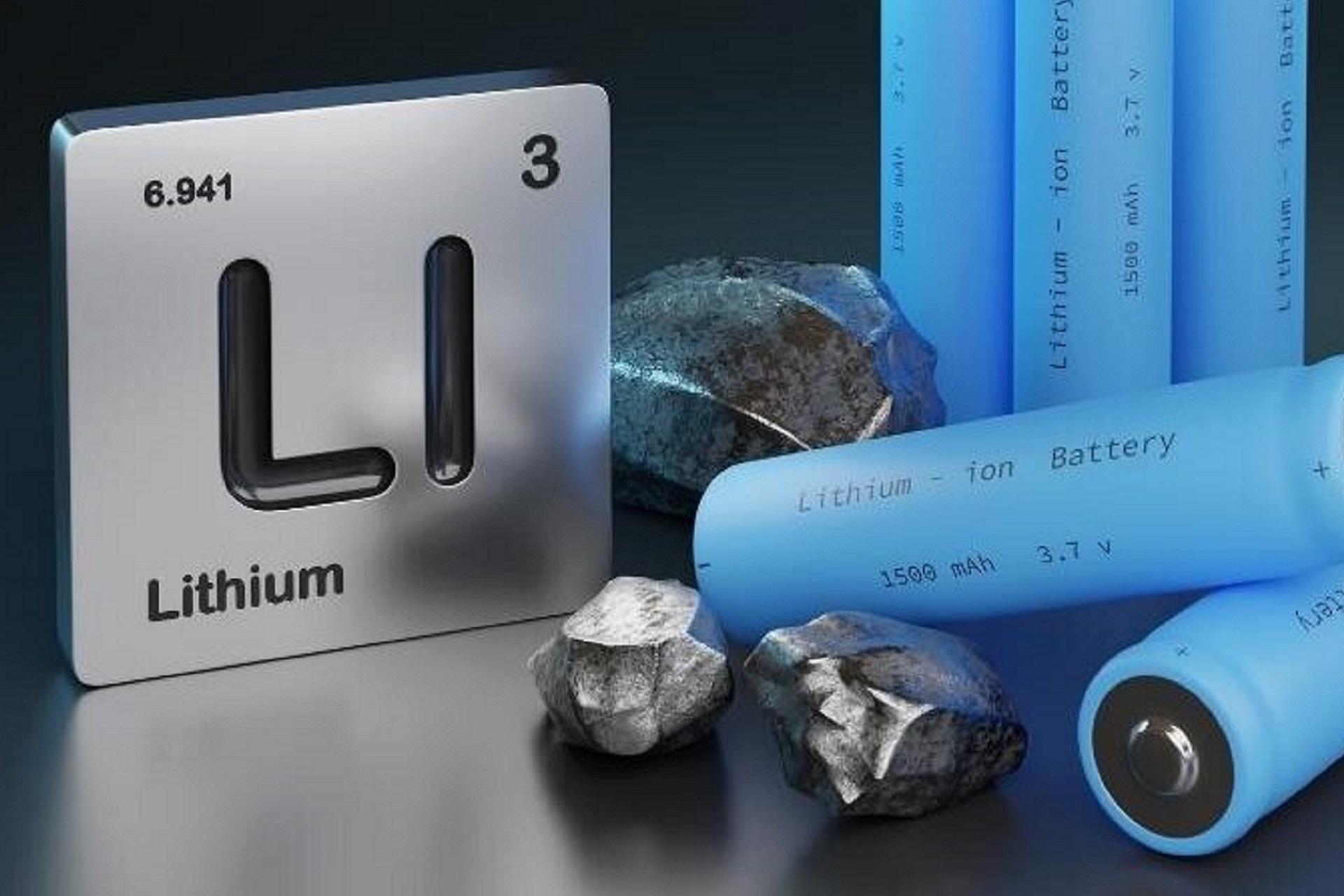

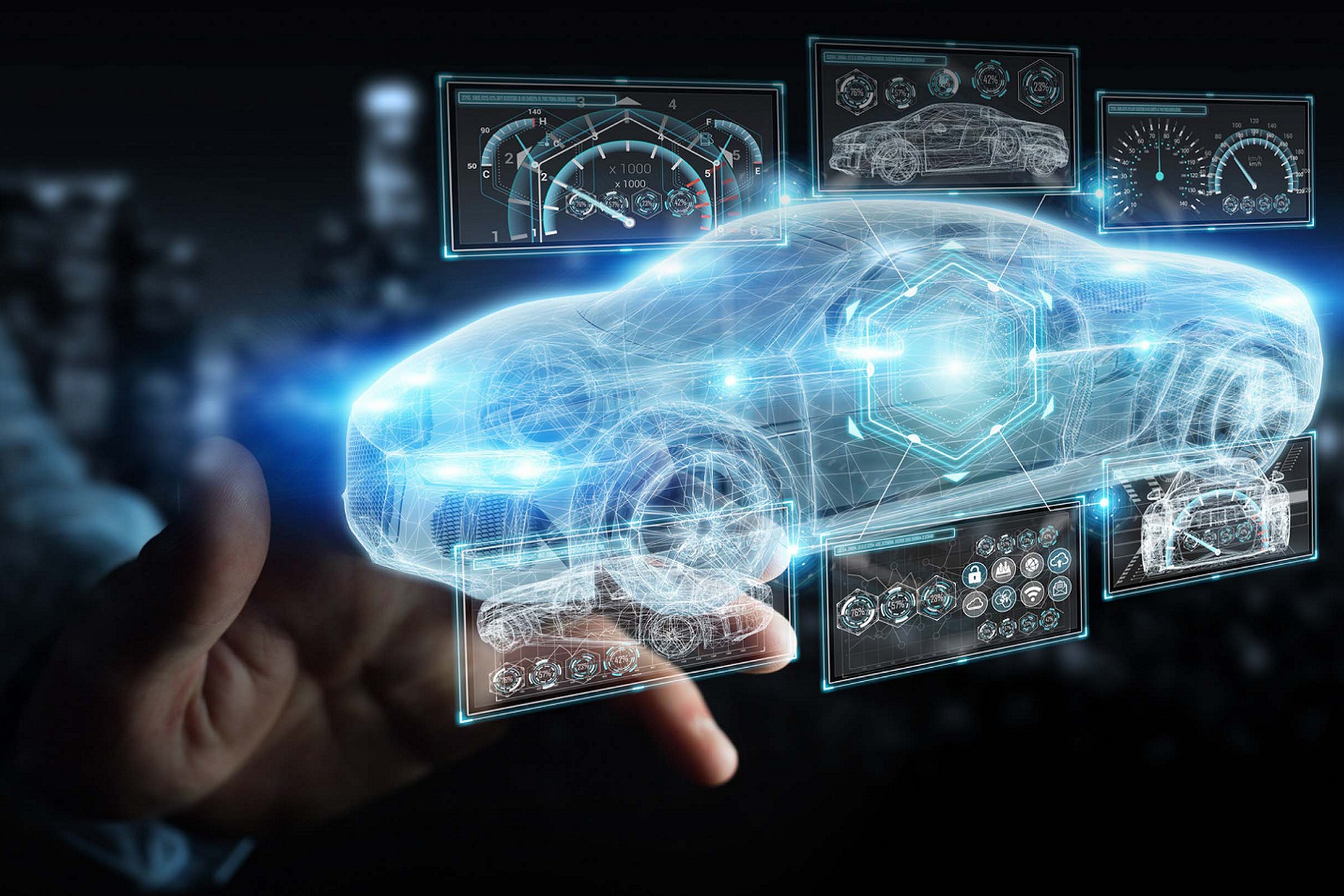

A battery electric vehicle contains twice as many semiconductors as a car with a combustion engine, up to 1,300 in total per car as most of these can be found in the powertrain and the inverter. Markus Hackmann, Managing Director of the consulting company P3 Group, explains that an analysis four years ago recognized that the semiconductors would evolve as the new battery cells. The P3 Group calculates that only eight percent of semiconductor products end up in cars. 80 percent, on the other hand, are used in consumer electronics. However, electrification and driving automation will increase this share.

At the same time, P3 is working on greater transparency about the supply chains. This transparency delivers the potential for improvements and more accurate delivery forecasts. The next step: adding alternative shipment services that get the chips to their destination to ease logjams downstream. DHL Express, for example, has launched new weekly flights from Ho Chi Minh City to the U.S., which adds up to 102 tons of additional capacity, and is an alternative to the current flights that land in the U.S. via Hong Kong. Vietnam’s business-friendly government, expanding digital ecosystem, and fast-growing economy have helped the sector attract major foreign players. Samsung, Qualcomm, SK Hynix, and NXP Semiconductors are just a few of the multinational corporations that have built research centres and factories in the Southeast Asian country.

Shipments can currently take up to 72 weeks for an order to arrive. The automotive industry needs to reorganize itself. Many parties involved in the automotive industry would not know who is the producer and who is the middleman. Nevertheless, it will probably be years before supply chains can function smoothly again and (re-) localize some in countries in Europe, etc.

The disaster due to the lack of semiconductors must not remain without consequence: the focus must be on regionalization. Intel has already announced that it wants to build a large plant in Magdeburg and invest 17 billion euros. Bosch from Dresden could contribute to easing the semiconductor crisis probably in 2023. But there are glimmers of hope that the crisis may be easing.

As a consequence, the pre-owned car market seized the opportunity to make its presence known in the market in India. It has been outpacing the new car market and is being dubbed the "Sunrise Sector" due to the sharp increase in demand for pre-owned cars. As per a recent report, the pre-owned car market is growing at a rate of 15 percent in FY22. The cost of owning a pre-owned vehicle is also much cheaper than owning a new one, mainly because of high depreciation rates, higher taxes, RTO/registration fees, and expensive vehicle insurance policies for the new cars. Along with the independent dealers, more and more car manufacturers are entering the market of pre-owned cars like Maruti’s True Value, Mahindra’s First Choice, and even companies like Porsche are foraying into the pre-owned market in India. This market could present tricky competition to the electric vehicle market as a stranger impact of the semiconductor crisis.

Please Login / register to post your comments!!

0 Comments