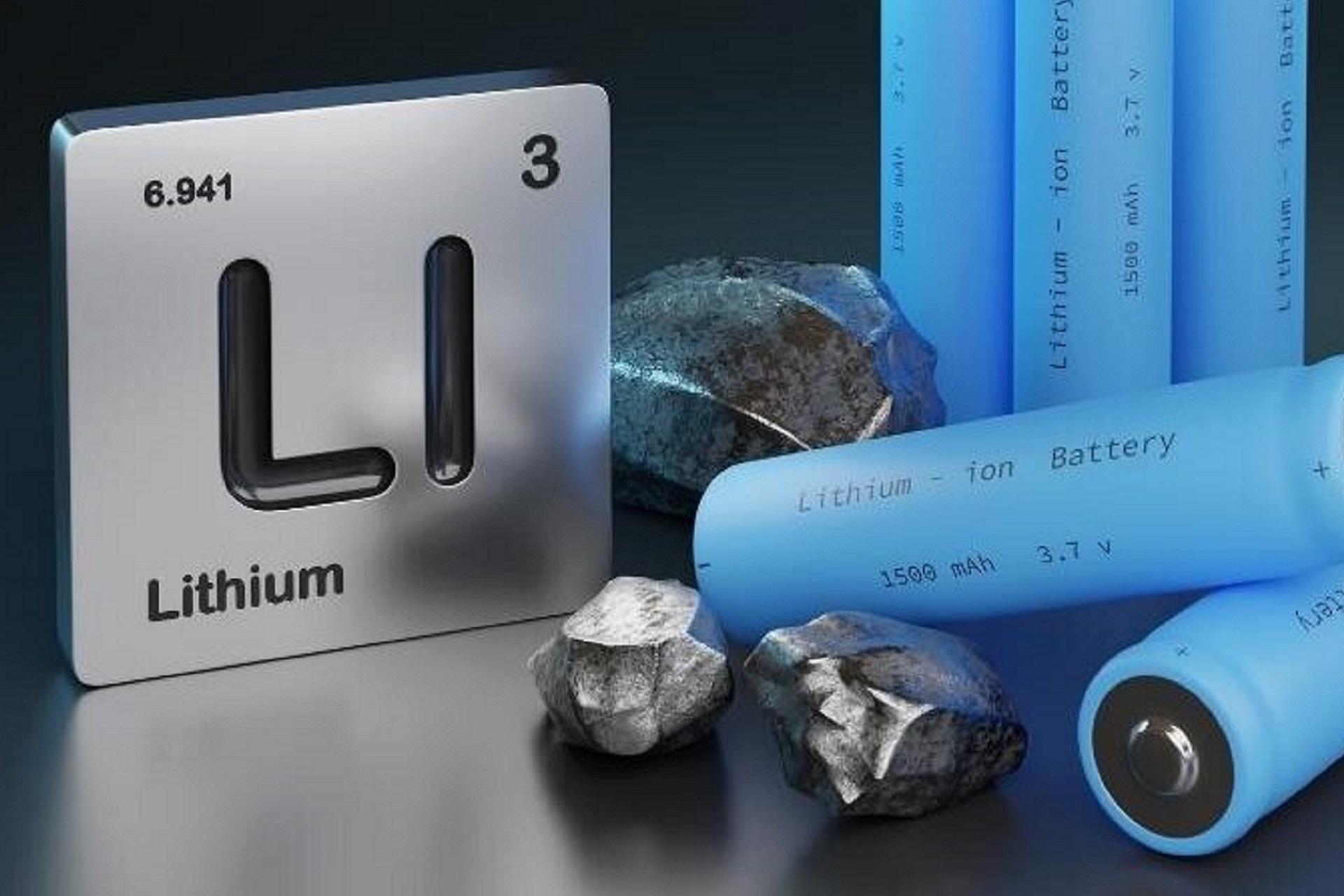

India is aiming to indulge in the global supply chain for making advanced cell technologies. Manufacturing these advanced energy storage devices in India could qualify domestically sourced batteries to cater to the demand generated from electric vehicle manufacturers, grid storage applications, and consumer electronics. India presently imports not only large amounts of fossil fuels but also equipment and materials required for renewable energy projects like solar PV modules and lithium-ion batteries. Domestic manufacturing would bring promising and profitable results for national energy security.

Here are the highlights from a new report published by Indian government think tank NITI Aayog and the global and India offices of non-profit research group Rocky Mountain Institute (RMI) about advancements in the battery sector-

India can meet domestic battery demand in 2022 with two gigafactories of the nameplate capacity of 10 GWh of annual production.

A process of evaluation is underway to support the creation of 50GWh of domestic production capacity across up to 10 new facilities making so-called Advanced Chemistry Cells (ACC), through a scheme called the Production Linked Incentive (PLI).

Over ₹ 200 crores of financial assistance are available for India or overseas-headquartered companies that build cell gigafactories, each with at least 5GWh annual production capacity.

Demand for batteries in India is expected to rise to between 106GWh and 260GWh by 2030 across sectors including transport, consumer electronics, and stationary energy storage, with the country racing to build up a localized value chain.

According to the India Energy Storage Alliance (IESA), only around 85MWh of battery energy storage systems (BESS) are in construction or already online in the country, but there is a pipeline of 4.6GWh already (3.3GWh tendered for and 1.2GWh announced).

There are many different value streams for energy storage for India’s power grid transmission utilities and distribution companies (discoms) that can be tapped, sustaining the network’s reliability and efficiency.

Growth in the renewable energy market will lead naturally to a big market opportunity for stationary energy storage systems (ESS), given the wide variety of services they can provide and their declining costs mean that ESS is becoming competitive with incumbent technologies.

With a high penetration of EVs and stationary energy storage, India alone could represent 13% of the total demand for batteries in the world.

Stationary energy storage, grid support ancillary services, renewables integration, transmission and distribution (T&D) upgrade deferral, and commercial behind-the-meter (BTM) will all be highly attractive markets by 2030.

Please Login / register to post your comments!!

0 Comments